|

|

| 5348 SCOTT CHURCH RD |

|

| LUCAMA , NC 27851 |

|

| Property

Location Address |

|

| Parcel

ID No. |

2790235641.000 |

| PIN |

2790 23 5641 000 |

| Owner ID |

1040022 |

| |

|

| Tax

District |

15 - C/SW/CROSSROADS FD |

| |

| Land Use Code |

50 |

| Land Use Desc |

RURAL HOMESITE |

| |

|

| Neighborhood |

8081 - CROSSROADS_TWP |

|

| Legal

Desc |

5337 SCOTT CHURCH RD |

| |

L1 G FERRELL LD 9.00AC |

| |

|

| Deed

Year Bk/Pg |

2007 - 2291 / 768 |

| Plat

Bk/Pg |

9 / 136 |

| |

Sales

Information |

| |

| Grantor |

|

| |

|

| Sold

Date |

0--0 |

| Sold

Amount $ |

0 |

|

| |

| Market Value $ |

173,069

|

| |

|

Market

Value - Land and all permanent improvements,

if any, effective January 1, 2024, date

of County’s most recent General Reappraisal

|

|

| |

|

| Assessed Value $ |

156,860

|

| |

If

Assessed Value not equal Market Value then

subject parcel designated as a special

class -agricultural, horticultural, or

forestland and thereby eligible for taxation

on basis of Present-Use.

|

|

|

| Year

Built |

1910 |

| Built

Use/Style |

SFR-1.0 STY |

| Grade |

C+05 / C+05 GRADE |

| * Percent

Complete |

100 |

| Heated

Area (S/F) |

1,635 |

| Fireplace

(Y/N) |

N |

| Basement

(Y/N) |

N |

| ** Bedroom(s) |

3 |

| ** Bathroom(s) |

2 Full Bath(s) 0 Half Bath(s) |

| *** Multiple

Improvements |

001 |

*

Note - As of January 1

*

* Note - Bathroom(s), Bedroom(s), shown for description

only

* * * Note - If multiple improvements equal “MLT” then

parcel includes additional major improvements |

|

| Photo |

Photo 1

|

|

| Building

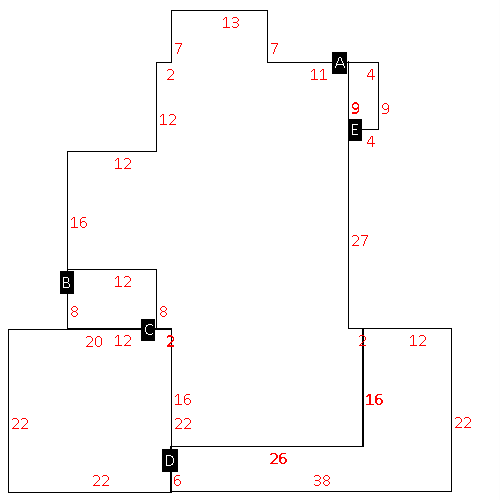

Sketch - NOTE: Sketches are updated the first day of every month. |

|

(Building 1) - Sketch for Parcel ID: 2790235641.000

NOTE: Sketches are updated the first day of every month.

|

| Label |

Description |

Base SF |

Total SF |

| A |

SFR-1.0 STY |

1635.00 |

1635.00 |

| B |

PORCH-ENCL-FR |

96.00 |

96.00 |

| C |

CARPORT |

484.00 |

.00 |

| D |

PORCH-OPEN-FR |

420.00 |

.00 |

| E |

PORCH-ENCL-FR |

36.00 |

36.00 |

|

|

|

|

|

| Map Acres |

9 |

| Tax District Note |

15 - C/SW/CROSSROADS FD |

| Present-Use Info |

RURAL HOMESITE |

| Zoning Code |

AR |

| Zoning Desc |

AGRICUL-RESID 40M SF |

|

| Total Improvements Valuation

|

*Total Improvements Full Market Value $

|

**Total Improvements Assessed Value

|

129,069

|

129,069

|

*

Note - Market Value effective Date equal January 1, 2024, date of County’s most recent General

Reappraisal

** Note - If Assessed Value not equal Market Value then variance

resulting from formal appeal procedure |

|

| Land

Value Detail (Effective Date January 1, 2024, date

of County’s most recent General Reappraisal) |

Land

Full Value (LFV) $

|

Land

Present-Use Value (PUV) $ **

|

Land

Total Assessed Value $

|

44,000

|

27,791

|

27,791

|

| **

Note: If PUV equal LMV then parcel has

not qualified for present use program |

|

| Land

Detail (Effective Date January 1, 2024, date of County’s

most recent General Reappraisal) |

Rate Type |

Rate Code |

Description |

Quantity |

AC |

5010 |

RURAL HOMESITE PAVED |

1.000 |

|

|

|

.000 |

AC |

5211 |

MKT OPEN LD PVD CLASS 2 |

.300 |

|

|

|

.000 |

AC |

5211 |

MKT OPEN LD PVD CLASS 2 |

7.700 |

LU |

5210 |

|

7.700 |

|

|

|

|